X has confirmed that the official U.S. Securities and Exchange Commission (SEC) account was breached when it posted the false announcement of the spot Bitcoin ETF approval.

SEC Account Lacked 2FA Protection

Following a preliminary inquiry, X has verified that the breach did not result from any weaknesses within their systems. Instead, an unidentified person managed to gain access to a phone number linked to the SEC account through a third party.

We can confirm that the account @SECGov was compromised and we have completed a preliminary investigation. Based on our investigation, the compromise was not due to any breach of X’s systems, but rather due to an unidentified individual obtaining control over a phone number…

— Safety (@Safety) January 10, 2024

Furthermore, it came to light that the account did not have two-factor authentication (2FA) in place when the breach occurred, underscoring the significance of users activating this extra layer of security.

Even after receiving assurances from X regarding the origin of the breach, U.S. senators and representatives expressed apprehensions, characterizing the incident as a possible instance of market manipulation. U.S. Senator Bill Hagerty strongly condemned the situation as “unacceptable,” and he called for accountability akin to what the SEC would demand from a public company responsible for a major market-altering mistake.

Just like the SEC would demand accountability from a public company if they made such a colossal market-moving mistake, Congress needs answers on what just happened. This is unacceptable. https://t.co/tWtLqHtqpu

— Senator Bill Hagerty (@SenatorHagerty) January 9, 2024

Lawmakers Demand Transparency from SEC

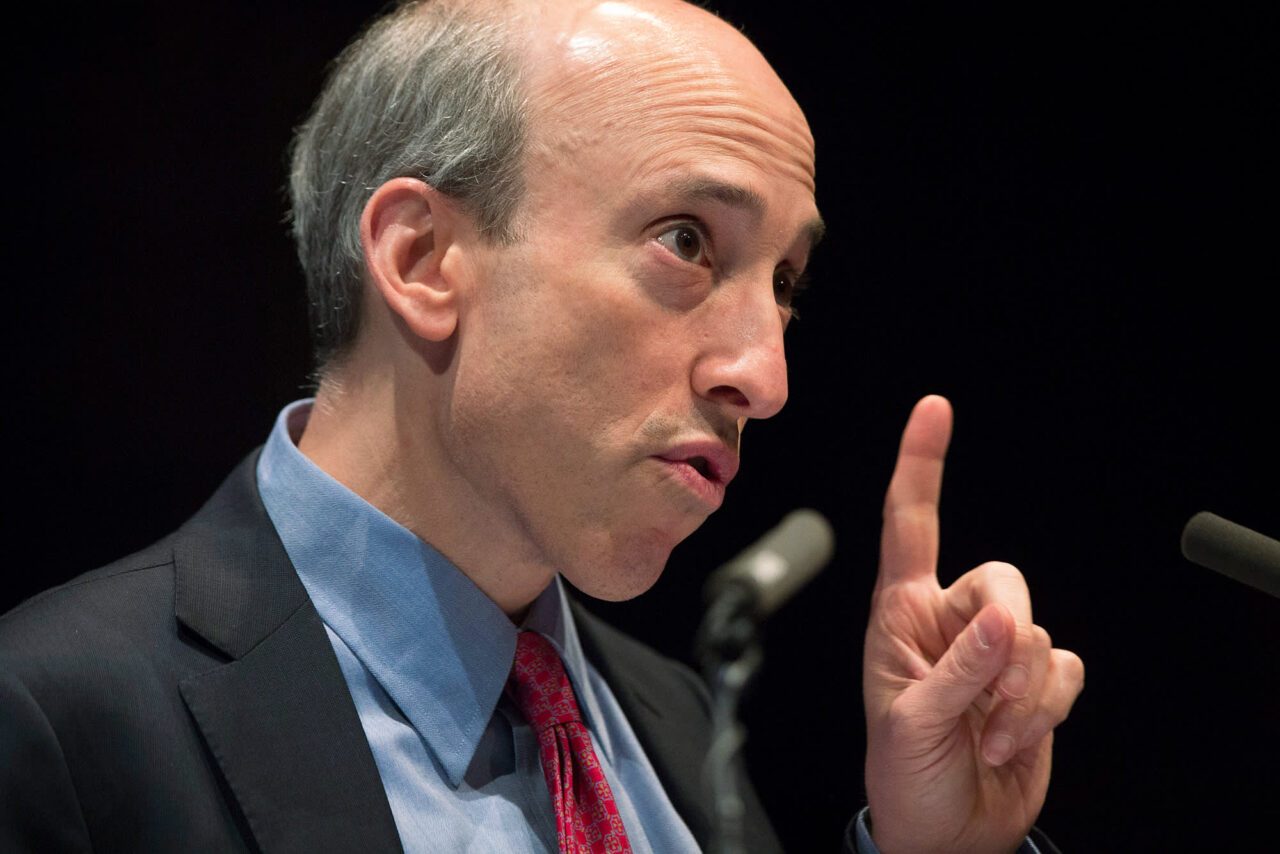

U.S. Senator Cynthia Lummis echoed these concerns, calling on the securities regulator to provide a clear account of the events leading up to the false post. Charles Gasparino of Fox Business even suggested that the SEC might need to initiate an internal investigation into potential market manipulation. U.S. Representative Ann Wagner took it a step further, labeling the incident as “unambiguous market manipulation” that impacted millions of investors and expressing her intention to seek answers from SEC Chair Gary Gensler.

Investment manager Timothy Peterson criticized the SEC’s ability to protect investors, highlighting the irony of an organization entrusted with safeguarding investors failing to secure its own social media account. Meanwhile, on social media platforms, various theories emerged, including speculation about a possible fat-finger error by SEC staff.

Despite these concerns, analysts believe that this security lapse is unlikely to cause a delay in the anticipated approval of the spot Bitcoin ETF, expected to occur later on Wednesday.

Lawmakers Scrutinize SEC Amid False Post

U.S. Senator Cynthia Lummis echoed these sentiments, calling upon the securities regulator to provide a transparent account of the events leading to the misleading post. Charles Gasparino from Fox Business even suggested that the SEC might find itself compelled to conduct an internal investigation regarding potential market manipulation. U.S. Representative Ann Wagner went a step further, characterizing the incident as “clear market manipulation” with far-reaching consequences for millions of investors, and she expressed her intent to seek answers from SEC Chair Gary Gensler.

Investment manager Timothy Peterson criticized the SEC’s ability to safeguard investors, highlighting the irony of an organization tasked with protecting investors failing to secure its own social media account. While speculations circulated on social media, some even raised the possibility of a fat-finger error on the part of SEC staff.

Analysts maintain that this security lapse is unlikely to impact the expected spot Bitcoin ETF approval scheduled for Wednesday.