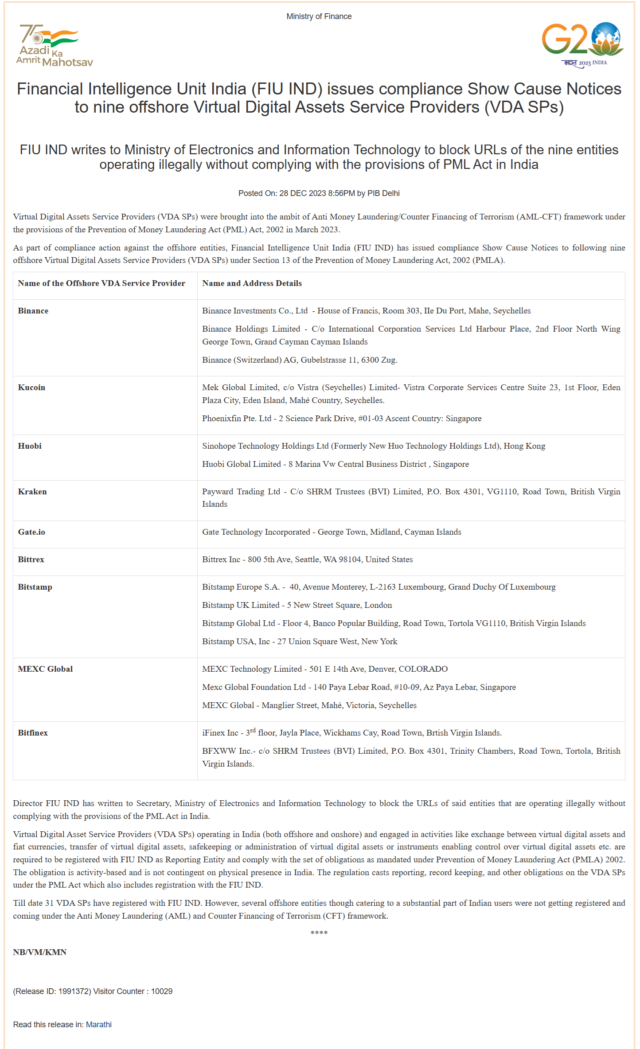

New Delhi: In a significant regulatory move, India’s Financial Intelligence Unit (FIU-India) has served show-cause notices to nine major offshore cryptocurrency platforms for alleged non-compliance with the country’s financial regulations. The directive, which targets industry giants including Binance, Kucoin, and Huobi, marks a pivotal moment in India’s approach to overseeing the burgeoning digital asset market.

According to a statement released by the Finance Ministry on Thursday, the notices are part of a broader effort to enforce the Prevention of Money Laundering Act (PMLA) 2002. This Act mandates virtual digital asset service providers operating in India to register with FIU-India as reporting entities, irrespective of their physical presence in the country.

The list of platforms issued notices also includes Kraken, Gate.io, Bittrex, Bitstamp, MEXC Global, and Bitfinex. These platforms are primarily accused of engaging in digital asset services, such as the exchange between virtual and fiat currencies, the transfer of digital assets, and their safekeeping, without adhering to the mandated compliance and reporting standards.

In an unprecedented move, the Director of FIU-India has also written to the Secretary, Ministry of Electronics and Information Technology, urging the blocking of URLs of these entities. This step reflects the government’s commitment to preventing illegal operations and ensuring a secure and regulated environment for digital asset transactions in India.

Gaurav Mehta, founder of Catax, a leading crypto bookkeeping and compliance solution, commented on the development. “This action by FIU-India is a clear signal that the government is looking to establish a robust regulatory framework for the cryptocurrency industry,” Mehta said. “It emphasizes the importance of compliance and transparency in the sector, which is crucial for its long-term sustainability and integration into the broader financial system.”

Mehta added, “As the industry matures, it’s imperative for platforms to align with local regulations, especially in key markets like India. This not only ensures the security of their operations but also builds trust among users and investors.”

The notices have stirred discussions within the cryptocurrency community, with many viewing this as a step towards more comprehensive regulation in the Indian market. It also underscores the government’s stance on activity-based obligations for digital asset service providers, focusing on the nature of their operations rather than their geographical location.

The move by FIU-India is expected to prompt a reevaluation of compliance strategies by digital asset platforms, especially those with a significant user base in India. As the regulatory landscape continues to evolve, industry stakeholders are keenly observing India’s approach to integrating digital assets into its financial system.