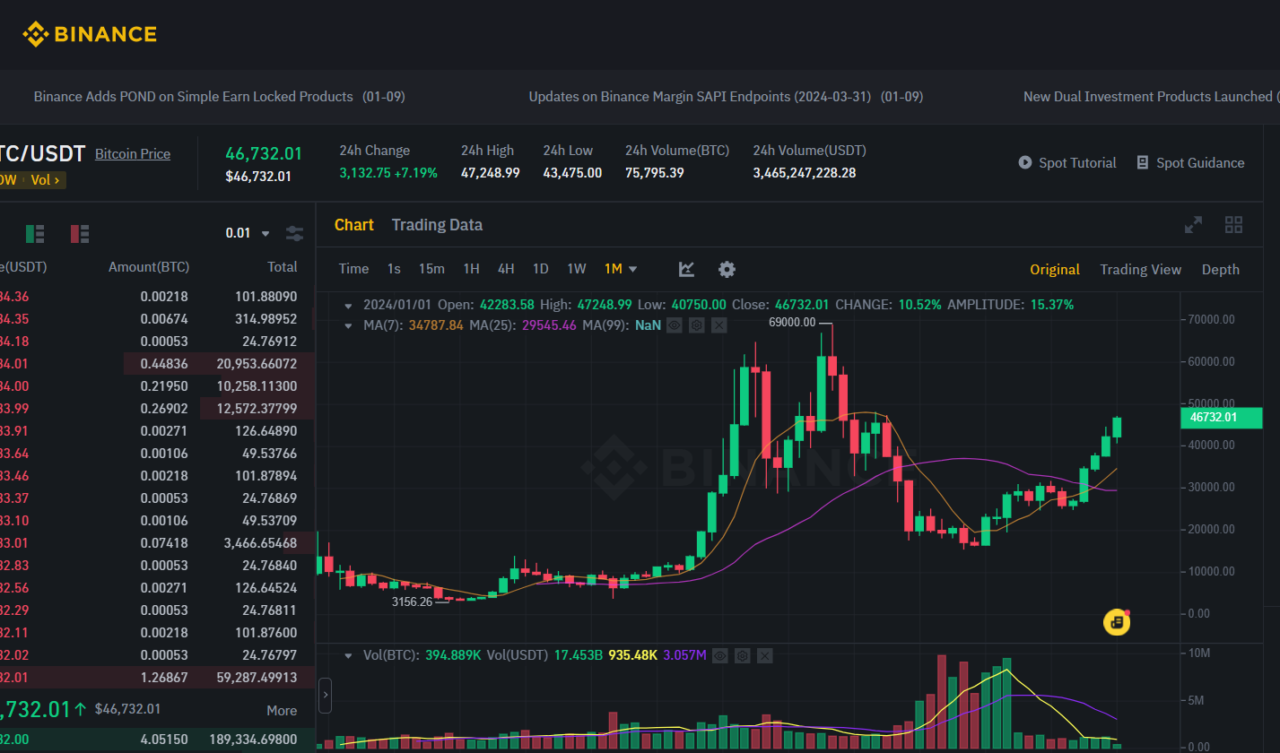

In a thrilling turn of events, Bitcoin (BTC) surged past $47,000 on Monday, marking a significant milestone not seen since April 2022. The cryptocurrency market is abuzz with anticipation as the U.S. Securities and Exchange Commission (SEC) is expected to make a historic decision on the approval of spot-based Bitcoin exchange-traded funds (ETFs) in the coming week. This surge in Bitcoin’s price, climbing nearly 7% over the past 24 hours, has investors eagerly awaiting the regulatory verdict, with many predicting a favorable outcome.

Gaurav Mehta, Founder of Catax, has been closely monitoring the developments surrounding spot-based Bitcoin ETFs and their potential impact on the cryptocurrency market. Mehta’s perspective on a positive SEC decision triggering a 15-20% price rally underscores the magnitude of expectations among investors and market participants.

Mehta believes that the approval of these ETFs has the potential to unlock a significant influx of sidelined capital into the cryptocurrency space. The appeal of a regulated and easily accessible investment vehicle like a Bitcoin ETF could resonate with both institutional and retail investors who have been hesitant to enter the crypto market due to regulatory concerns or technological barriers.

Major players in the asset management industry, including BlackRock, Fidelity, and Grayscale, have submitted updated S-1 filings to the SEC in their pursuit of launching spot Bitcoin ETFs. These issuers have also revealed the fees they plan to charge investors. The potential approval of these ETFs is seen as a game-changer that could significantly expand the investor base for Bitcoin, attracting substantial inflows of capital.

Joel Kruger, a market strategist at LMAX Group, echoes the sentiment, emphasizing that an SEC approval could have a profound impact on Bitcoin’s price. However, even in the event of a denial, projections indicate that Bitcoin is expected to find strong support above the $30,000 mark, reassuring investors in the cryptocurrency’s resilience.

Meanwhile, SEC Chair Gary Gensler has taken the opportunity to issue a warning to investors regarding the cryptocurrency sector. Gensler has emphasized the prevalence of scams and fraudulent activities within the crypto space and has stressed that many companies in the industry may not be in compliance with applicable laws, including federal securities laws. His cautionary messages serve as a reminder of the risks associated with investing in digital assets.

The cryptocurrency community and the broader U.S. financial sector are on tenterhooks, awaiting the SEC’s decision on spot Bitcoin ETFs. If approved, these fully regulated ETFs could pave the way for more accessible trading of digital assets, potentially ushering in billions of dollars in investments from even the most casual investors. However, the ongoing debate over whether cryptocurrency businesses are adhering to securities laws continues in various court cases, adding complexity to the regulatory landscape.

As the excitement builds and the crypto world awaits the SEC’s verdict, Bitcoin’s resurgence above $47,000 underscores the significance of the impending decision on spot-based Bitcoin ETFs, making it a pivotal moment in the cryptocurrency market’s evolution.