BounceBit has revealed its plan to democratize high-yield Bitcoin investing opportunities by integrating centralized and decentralized finance.

BounceBit, a new Bitcoin restaking startup supported by Binance, has outlined its 2024 roadmap, detailing key initiatives for this year.

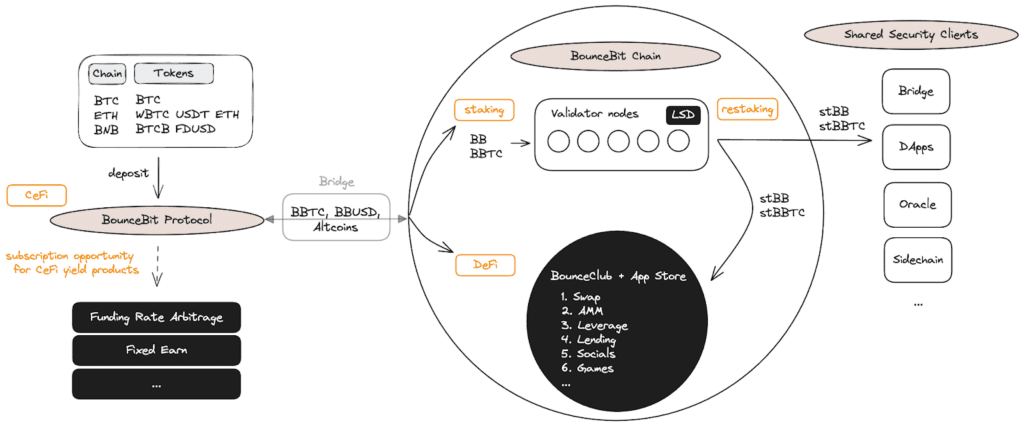

In a Medium blog post on May 20, BounceBit announced its goal to merge the structure and liquidity of centralized exchanges like Coinbase while developing decentralized infrastructure for Bitcoin “as an asset, without altering its core technology.” The startup clarified that it will not launch a sidechain or layer-2 solution, stating that “recent trends, like runes and BRC-20 tokens, seem to capitalize on temporary hype rather than addressing long-term needs.”

“You might not agree, the market might not agree, and that’s fine, we are venturing this road anyway.” – BounceBit

BounceBit’s 2024 roadmap, though undated, focuses on several major developments. The startup plans to enhance the BounceBit Chain—a proof-of-stake layer-1 chain secured by validators staking both Bitcoin and BounceBit’s native token BB—by optimizing the Ethereum Virtual Machine (EVM) execution layer for better node performance.

Other planned improvements include creating a shared security client module to allow other projects to use the liquidity of the BounceBit BTC restaking chain, developing a new mempool module for higher transaction throughput, and refining the communication layer between EVM and Cosmos SDK, a framework for building blockchain networks.

Besides infrastructure enhancements, BounceBit aims to introduce the Fixed Earn product, offering fixed income for Bitcoin and dollar assets, similar to traditional crypto lending. The company will also launch BounceClub, a service allowing users to create their own centralized-decentralized-finance (cedefi) products using BounceBit’s widget. For contract deployment, it’s understood that BounceBit will maintain a special whitelist, though the verification method is yet to be disclosed.

Earlier in April, Binance Labs, the venture arm of Binance, announced its investment in BounceBit. While the deal’s size has not been disclosed, Binance Labs’ Yi He stated that the startup “unlocks new avenues for Bitcoin’s utilization with the fusion of cefi and defi.”