Coin Center’s executive director, Jerry Brito, has expressed that complying with the cryptocurrency tax reporting guidelines set for 2024 remains ambiguous.

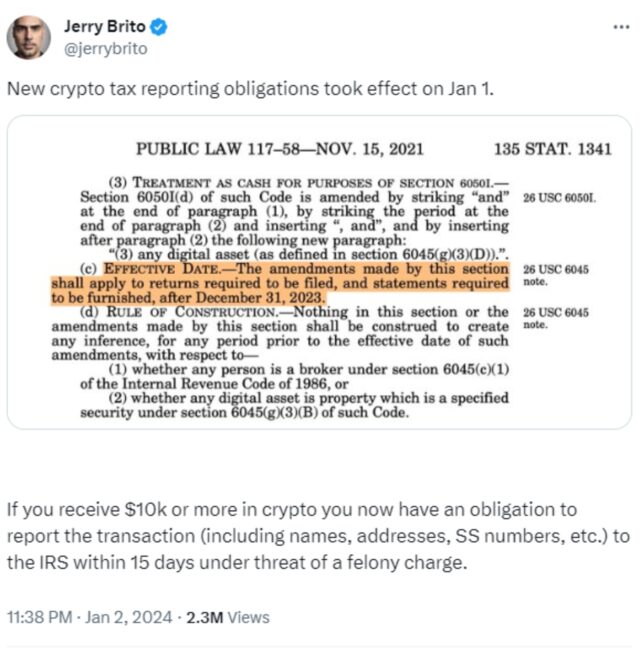

Key elements of the infrastructure bill signed by U.S. President Joe Biden are now operational. This includes mandates that digital asset transactions exceeding $10,000 be reported to the IRS.

The bipartisan bill, approved by Congress and enacted by President Biden in 2021, broadens the reporting obligations for brokers. It requires that crypto exchanges and custodians report transactions over $10,000 to the IRS. After the bill’s enactment, several legislators proposed additional measures to modify these reporting requirements, arguing that the data brokers were required to collect could be challenging or unfeasible to gather.

Under this legislation, crypto brokers must submit personal details of transactions to the IRS, such as the sender’s name, address, and social security number, within a 15-day window. These stipulations, designed to decrease the U.S. tax gap, were set to begin in January 2023, with companies beginning to report to the IRS in 2024.

Jerry Brito, the executive director of Coin Center, believes many users may struggle to meet these reporting demands without clear guidelines from the IRS. He anticipates that while individuals will try to adhere to the law, they may inadvertently face felony charges.

“When a miner or validator earns block rewards over $10,000, whose name, address, and Social Security number should they disclose?” He also asked, “In a situation where someone participates in a decentralized on-chain exchange of cryptocurrency and receives crypto worth $10,000, whom should they report to? And what criteria should be used to determine if a certain amount of cryptocurrency exceeds the $10,000 threshold?”

Brito added:

“The really tricky nature of this requirement will become clear when someone makes such a donation, but does so anonymously by simply sending us Bitcoin or Ether to our public addresses. Who could we possibly list as the sender in that case?”

In August, Coin Center suggested that the IRS create a minimal exemption for cryptocurrency transactions. This proposal aimed to clarify the ambiguous reporting guidelines and prevent the government from imposing regulations on secondary parties in crypto transactions. Since 2019, the IRS has mandated U.S. taxpayers to disclose their digital asset transactions. However, with the expansion of these mandates under the bipartisan infrastructure law, reporting in 2024 could become more challenging.