The decision aligns with Japan’s yen facing pressures due to the country’s fiscal challenges.

- Metaplanet integrates bitcoin into its reserve assets to mitigate risks associated with Japan’s increasing debt levels and yen instability.

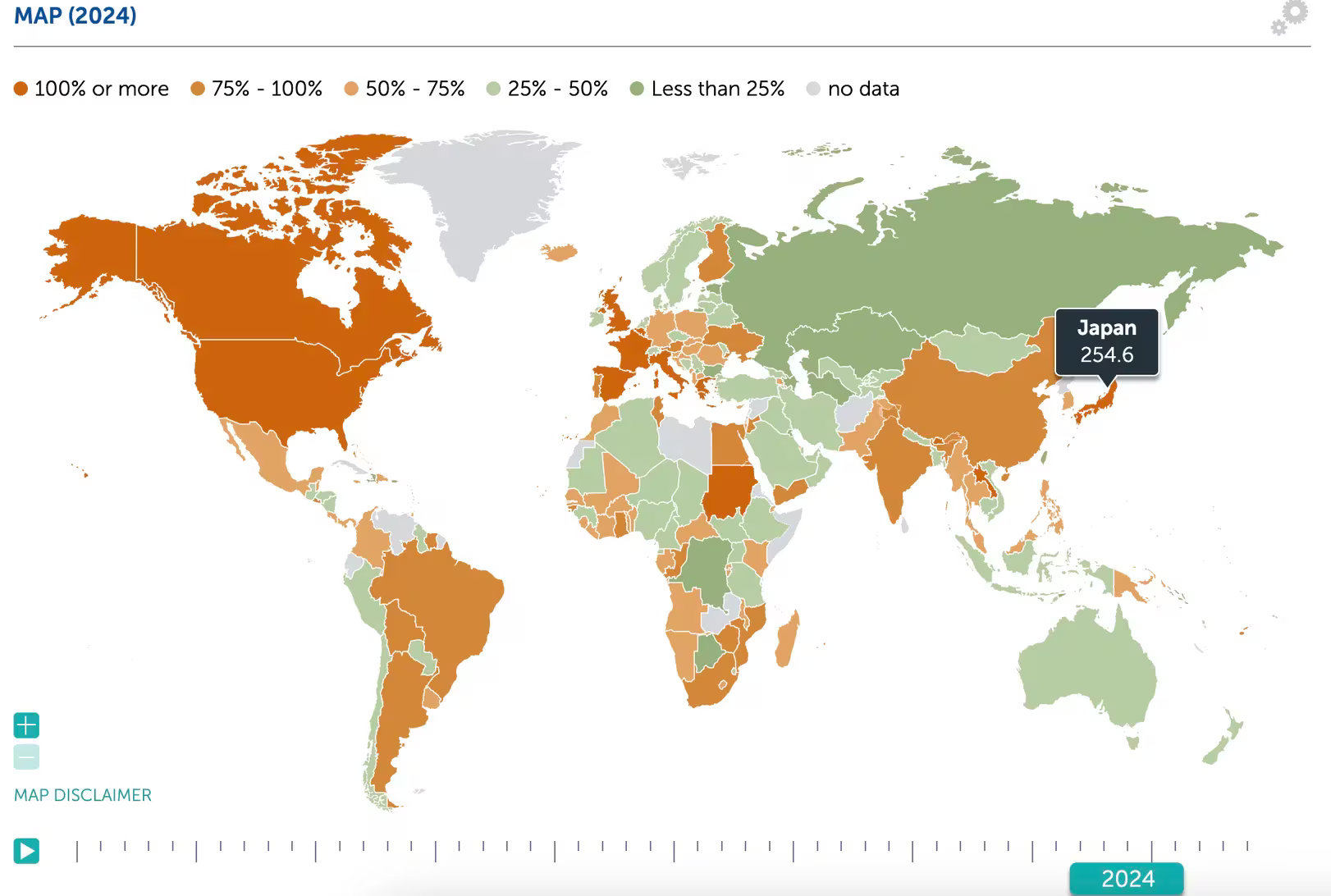

- With Japan’s debt-to-GDP ratio surpassing 250%, it leads among developed nations in debt burden, according to IMF data.

Tokyo-based investment firm Metaplanet strategically embraces bitcoin (BTC) as a reserve asset to counteract the escalating debt and resultant volatility of the yen in Japan.

Metaplanet’s adoption of bitcoin as a reserve asset aims to hedge against Japan’s mounting debt and the resulting fluctuations in the yen.

“Metaplanet’s decision to integrate bitcoin into its reserve assets is a direct response to ongoing economic challenges in Japan, including elevated government debt levels, prolonged periods of negative real interest rates, and the resultant weakening of the yen,” the company stated in a press release on Monday.

Since April, Metaplanet has acquired 117.7 BTC ($7.19 million), following the footsteps of U.S.-based MicroStrategy (MSTR), which has procured several billion dollars worth of bitcoin, according to data from Bitcointreasuries.net. Transitioning away from its previous involvement in Web3, Metaplanet now focuses solely on bitcoin alongside exposure to commercial real estate.

This strategic move by Metaplanet coincides with Japan’s fiscal turmoil unfolding in the currency markets. Advocates of cryptocurrency have long touted bitcoin as a safeguard against fiscal and monetary recklessness.

According to data tracked by the International Monetary Fund, Japan’s gross debt-to-GDP ratio currently exceeds 254%, surpassing that of other advanced economies. In contrast, the U.S. debt-to-GDP ratio has surpassed 123%.

The substantial debt burden has hindered the Bank of Japan (BOJ) from raising interest rates in tandem with other major central banks like the Federal Reserve (Fed). Elevated interest rates amplify the cost of servicing debt, exacerbating fiscal challenges.

“While the Federal Reserve has gradually raised rates to over 5% since early 2022, Japan’s benchmark borrowing cost remains close to zero. Consequently, the yen, a key global reserve currency, has experienced significant depreciation,” the report indicates.

TradingView data illustrates that the Japanese yen has depreciated by 50% against the U.S. dollar since early 2021. Recently, the yen dipped below 155 per U.S. dollar, marking a 34-year low. To counteract this downward trend, the BOJ reportedly intervened in the currency market, selling dollars to stabilize the yen.

“As the yen continues to weaken, bitcoin emerges as a non-sovereign store of value that has the potential to appreciate against traditional fiat currencies,” Metaplanet emphasized. The company critiqued the BOJ’s strategy of maintaining low rates while intervening in FX markets, dubbing it an “unsustainable monetary paradox.”

Metaplanet intends to retain bitcoin for the long term to minimize realized taxable gains. Additionally, the company plans to augment its bitcoin holdings by issuing long-dated yen liabilities when favorable opportunities arise.